5th Barcelona Summer School of Stochastic Analysis and Quantitative Finance

Sign into July 25, 2025

150€ Registration includes coffee breaks, gala dinner and guided visit.

EVENT SUMMARY

PRESENTATION

The goal of the summer school is to offer advanced courses on topics of interest to the research group, taught by professors of recognized prestige, and aimed at doctoral students, postdoctoral fellows and researchers. The activity is interesting for the research group because it allows us to keep in touch with the most current research, offer training to our PhD students and young researchers and project ourselves internationally. In addition, it also helps the international projection of research in Stochastic Analysis and Mathematics in Catalonia. On other hand, we want to recover and resume the series of summer schools that we organized at CRM between 2012 and 2018, and that was stopped because of the pandemic.

PRESENTATION

The goal of the summer school is to offer advanced courses on topics of interest to the research group, taught by professors of recognized prestige, and aimed at doctoral students, postdoctoral fellows and researchers. The activity is interesting for the research group because it allows us to keep in touch with the most current research, offer training to our PhD students and young researchers and project ourselves internationally. In addition, it also helps the international projection of research in Stochastic Analysis and Mathematics in Catalonia. On other hand, we want to recover and resume the series of summer schools that we organized at CRM between 2012 and 2018, and that was stopped because of the pandemic.

DESCRIPTION

These will be the courses:

-

Rough Volatility

-

Signatures in Stochastic Finance

-

Weather Derivatives

Organising & Scientific Committee

Elisa Alòs | Universitat Pompeu Fabra

José Manuel Corcuera | Universitat de Barcelona

Carlos Escudero | UNED

Luis Ortiz | Universitat de Barcelona

Rafael de Santiago | IESE

Wim Schoutens | KU Leuven

Josep Vives | Universitat de Barcelona

Lecturers

Rough Volatility

Abstract

The course overviews basic ideas in rough volatility modeling from the viewpoints of i) historical volatility dynamics, ii) implied volatility term structure, and iii) market microstructure. Instead of covering the strongest results up to date, it is meant to bring the understanding of the rough volatility phenomena through the simplest computations. Emphasis will be put on its relations to more traditional models, including local-stochastic volatility models, fast-mean reverting models with long memory, and stable-type jump diffusion models.

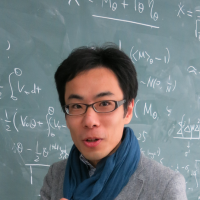

Masaaki Fukasawa

Osaka University

Fukasawa is a Professor of Mathematics at Osaka University and has focused his research on the concept of “skewness.” His initial work involved the Edgeworth expansion for ergodic diffusions, which improves the normal approximation to a probability distribution. Later, he applied these results to mathematical finance, linking the skewness of price distributions to the “volatility skew” in the Black-Scholes implied volatility surface. Additionally, he has explored how skewness and kurtosis affect the asymptotic distribution of volatility estimators and discretization errors in stochastic integration, developing Kurtosis-Skewness inequalities for random variables.

Personal Website

An introduction to signatures with applications in finance

Abstract

Path signature were introduced by K. T. Chen in the 50s for smooth paths and later extended to rough paths by T. Lyons in the 90s — in fact, they form the basic building block of Lyons’ theory of rough paths. Signatures are a convenient and efficient way to encode paths, i.e., functions from, say, [0,T] to R^d. Indeed,

1. a path’s signature essentially characterizes the underlying path, and

2. the set of linear functionals of the signature forms a sub-algebra of the continuous functions of paths.

As a consequence, (linear or non-linear functionals of) signatures form a natural set of basis functions for approximation of functions on path-space, similar to the role of polynomials on finite-dimensional Euclidean space. In particular, they are universal approximators.

In this minicourse, we will provide a gentle introduction into signatures, discuss applications of signatures to machine learning (when the input data are time series). Finally, we show how signatures can be used as fundamental building blocks for constructing numerical algorithm for solving optimal stopping or more general stochastic optimal control problems, when the underlying stochastic process lacks the Markov property — such as in rough volatility models.

Christian Bayer

Technical University Berlin

Bayer is a Professor at the Weierstrass Institute for Applied Analysis and Stochastics in Berlin. His research primarily focuses on financial mathematics and stochastic numerics. One of his major projects involves modeling stock indices like the S&P 500 consistently with the implied volatility surface and the volatility index (VIX). He has also worked extensively on rough volatility models, which present significant theoretical and numerical challenges. Additionally, Bayer is interested in the numerical approximation of stochastic optimal control problems and the application of rough path theory to machine learning and stochastic control.

Personal Website

Weather Derivatives

Abstract

Weather derivatives are financial contracts written on weather events, and provide a protection against financial risks imposed by undesirable weather events. Weather derivatives contracts are traded on temperature indices and wind. We discuss various weather derivatives and their use, as well as the weather risk exposure in renewable energy markets. In the next step, we present various stochastic processes modelling temperature, wind as well as solar irradiation, suitable for describing the weather risk and analysing weather derivatives. Particular attention is paid to continuous-time autoregressive models, and several case studies are presented where we fit the models to observed weather data. Our focus is then turned to pricing weather fututers, where we introduce so-called pricing measures. We show that the risk premium in temperature markets varies with the temperature. To account for this effect, we introduce pricing meaures being explicitly dependent on the temperature. We finally discuss some hedging aspects concerning basis risk and the use of standardized weather derivatives.

Fred E. Benth

Oslo University

Benth is a Professor at the University of Oslo’s Department of Mathematics, specializing in risk and stochastics. His research interests include stochastic analysis, mathematical finance, and energy markets. Benth has made significant contributions to the modeling of energy markets, particularly in the context of pricing and risk management. His work often involves the application of stochastic processes to real-world financial and energy market problems, providing valuable insights into market behaviors and risk assessment.

Personal Website

POSTER SESSION INFORMATION

To apply, please select the relevant option during the registration process.

- Deadline: June 15, 2025

- Resolutions will be sent by June 30, 2025

SCHEDULE

Monday July 21st, 2025 | Tuesday July 22nd, 2025 | Wednesday July 23rd, 2025 | Thursday July 24th, 2025 | Friday July 25th, 2025 | |

9:00 - 9:20 | Registration | ||||

9:20 - 9:30 | Welcome | ||||

9:30 - 10:30 | An introduction to signatures with applications in finance Christian Bayer Technical University Berlin | Rough Volatility Masaaki Fukasawa Osaka University | An introduction to signatures with applications in finance Christian Bayer Technical University Berlin | An introduction to signatures with applications in finance Christian Bayer Technical University Berlin | Weather Derivatives Fred E. Benth Oslo University |

10:30 - 11:00 | Coffee break | Coffee break | Coffee break | Coffee break + Group picture | Coffee break |

11:00 - 13:00 | Rough Volatility Masaaki Fukasawa Osaka University | An introduction to signatures with applications in finance Christian Bayer Technical University Berlin | Rough Volatility Masaaki Fukasawa Osaka University | Weather Derivatives Fred E. Benth Oslo University | Weather Derivatives Fred E. Benth Oslo University |

13:00 - 14:30 | Lunch time | ||||

14:30 - 16:30 | Contributed talks Daniele Angelini Sapienza University of Rome --- Martin Bergerhausen University of Mannheim --- Òscar Burés Universitat de Barcelona --- Ranieri Dugo University of Rome Tor Vergata --- Héctor Folgar Cameán Universidade Da Coruña --- Benjamin Massat Paul Sabatier University - Toulouse III | Contributed talks Mihriban Ceylan University of Mannheim --- Emmanuel Gnabeyeu Pierre-and-Marie-Curie University --- Azmat Hussain University of Central Asia --- Gero Junike University of Oldenburg --- Rubén Jiménez Universitat de Barcelona | Contributed talks Argimiro Arratia Universitat Politècnica de Catalunya --- Emmet Lawless Dublin City University --- Ahmed Wafi Ludwig Maximilian University of Munich --- Giacomo Zarfati Sapienza University of Rome | ||

16:30 - 17:30 | Poster session + Reception | ||||

17:00 - 19:30 | Guided Visit | ||||

19:30 - 20:30 | Free time | ||||

20:30 | Dinner in Barcelona | ||||

Contributed Talks & Poster Session

LIST OF PARTICIPANTS

| Name | Institution |

|---|---|

| Magdalena Mikic | Josip Juraj Strossmayer University of Osijek |

| Davide Carini | Università Europea di Roma |

| Gero Junike | LMU Munich |

| Amal Omrani | Paris Dauphine-PSL University |

| Rémi Durand | Ecole Nationale des Techniques Avancées |

| Mohammed Benasquar | Mohammed First University, Faculty of Science |

| Carlos Vazquez | Universidade da Coruña |

| Marc Jovani | UNED |

| Christian Bayer | Technical University Berlin |

| Neil Lamas | ICMAB (CSIC) |

| Azmat Hussain | University of Central Asia |

| José M. Corcuera | Universitat de Barcelona |

| Francesc Timoner Vaquer | Universitat de Barcelona |

| Oriol Tubella Domingo | Universitat de Barcelona |

| Carlos Allué Buesa | Universitat de Barcelona |

| Sara Solanilla Blanco | Universitat de Barcelona |

| Yuanxi He | Universitat de Barcelona |

| Rubén Jiménez | Universitat de Barcelona |

| Òscar Burés | Universitat de Barcelona |

| Luis Ortiz Gracia | Universitat de Barcelona |

| Josep Vives | Universitat de Barcelona |

| Alejandra Cabaña | Universitat Autònoma de Barcelona |

| Marc Cano i Cànovas | Universitat Autònoma de Barcelona |

| Benjami Parellada | Universitat Politècnica de Catalunya |

| Fernando Muñoz | Universitat Politècnica de Catalunya |

| Argimiro Arratia | Universitat Politècnica de Catalunya |

| Sara Guaitoli | Universitat Politècnica de Catalunya |

| Elisa Alòs | Universitat Pompeu Fabra |

| Sergi Arjo Segovia | Universitat Rovira i Virgili |

| Carlos Cañada | Universidad de Extremadura |

| Albert Cabré | Universidad Nacional de Educación a Distancia |

| Carlos Escudero | Universidad Nacional de Educación a Distancia |

| Miguel Sama | Universidad Nacional de Educación a Distancia |

| Francisco Parúas | Universidad Nacional de Educación a Distancia |

| Rafael De Santiago | Universidad de Navarra |

| Héctor Folgar Cameán | Universidade Da Coruña |

| Florian Gabriel Walter Ostendorf | Vienna University of Technology |

| Mikkel Mandrup Nielsen | Aalborg University |

| Sigui Brice Dro | Pierre-and-Marie-Curie University |

| Emmanuel Gnabeyeu | Pierre-and-Marie-Curie University |

| Simon Delalande | Paul Sabatier University - Toulouse III |

| Benjamin Massat | Paul Sabatier University - Toulouse III |

| Ahmed Wafi | Ludwig Maximilian University of Munich |

| Christoph Gärtner | Kaiserslautern University of Technology |

| Martin Bergerhausen | University of Mannheim |

| Mihriban Ceylan | University of Mannheim |

| Daniel Boros | Eötvös Loránd University |

| Emmet Lawless | Dublin City University |

| Marco Amatangelo | Sapienza University of Rome |

| Giacomo Zarfati | Sapienza University of Rome |

| Daniele Angelini | Sapienza University of Rome |

| Daniele Rossi | University of Naples Federico II |

| Ranieri Dugo | University of Rome Tor Vergata |

| Yizheng Zhang | Polytechnic University of Milan |

| Michele Paganelli | University of Modena and Reggio Emilia |

| Matteo Ziglioli | University of Brescia |

| Alessandro Cobis | Roma Tre University |

| Lorenzo Lombardi | University of Salerno |

| Masaaki Fukasawa | Osaka University |

| Konstantinos Chatziandreou | University of Amsterdam |

| Fred E. Benth | University of Oslo |

| Karl Malterling Ruderfors | Royal Institute of Technology |

| Gabriel Garcia | University of Oxford |

| Samira Amiriyan | University of Liverpool |

| Leonardo Baggiani | University of Warwick |

INVOICE/PAYMENT INFORMATION

IF YOUR INSTITUTION COVERS YOUR REGISTRATION FEE: Please note that, in case your institution is paying for the registration via bank transfer, you will have to indicate your institution details and choose “Transfer” as the payment method at the end of the process.

UPF | UB | UPC | UAB

*If the paying institution is the UPF / UB/ UPC / UAB, after registering, please send an email to comptabilitat@crm.cat with your name and the institution internal reference number that we will need to issue the electronic invoice. Please, send us the Project code covering the registration if needed.

Paying by credit card

IF YOU PAY VIA CREDIT CARD but you need to provide the invoice to your institution to be reimbursed, please note that we will also need you to send an email to comptabilitat@crm.cat providing the internal reference number given by your institution and the code of the Project covering the registration (if necessary).

LODGING INFORMATION

ON-CAMPUS AND BELLATERRA

BARCELONA AND OFF-CAMPUS

|

For inquiries about this event please contact the Scientific Events Coordinator Ms. Núria Hernández at nhernandez@crm.cat

|

acknowledgement

scam warning

We are aware of a number of current scams targeting participants at CRM activities concerning registration or accommodation bookings. If you are approached by a third party (eg travellerpoint.org, Conference Committee, Global Travel Experts or Royal Visit) asking for booking or payment details, please ignore them.

Please remember:

i) CRM never uses third parties to do our administration for events: messages will come directly from CRM staff

ii) CRM will never ask participants for credit card or bank details

iii) If you have any doubt about an email you receive please get in touch